Wage Portage: Definition and Operation

In a constantly evolving professional environment, wage portage stands out as an ideal alternative between independent work and traditional employment. It allows experts, freelancers, and transitioning executives to work autonomously while benefiting from the advantages of employee status.

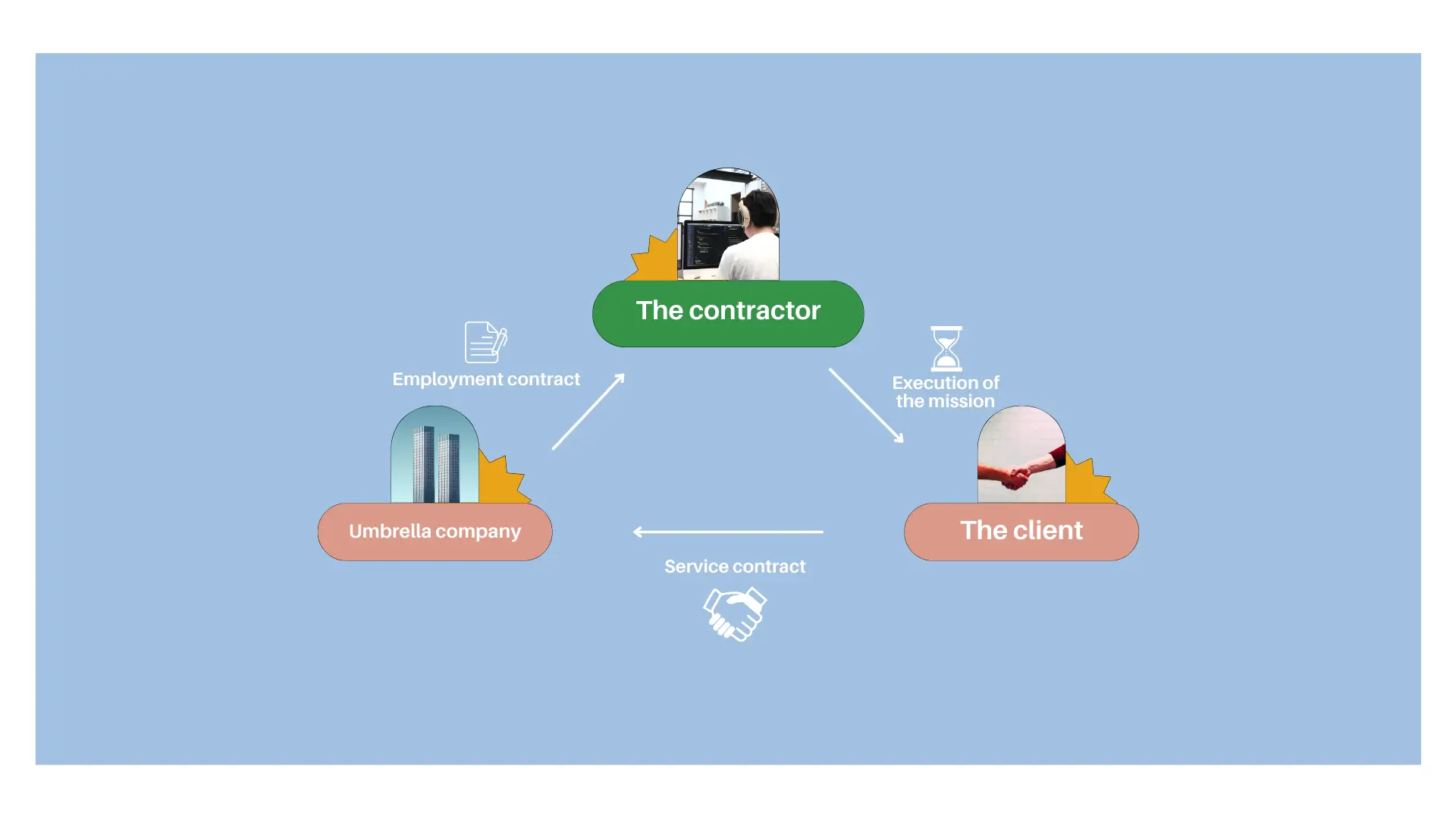

This model is based on a tripartite relationship between the contracted employee, the umbrella company, and the client company. Thanks to this framework, the professional can focus on their activity while delegating administrative tasks. Weepo explains everything you need to know about wage portage through this comprehensive guide!

Article Summary

- Professional Freedom: choose your missions, negotiate your rates, and organize your schedule.

- Comprehensive Social Security: unemployment, retirement, health insurance, and paid leave included.

- Simplified Management: Weepo handles invoicing, social charges, and administrative procedures.

- Personalized Support: a dedicated advisor guides you at every step.

- High-Performance Digital Tools: easily track your missions and earnings.

Summary

What is Wage Portage?

Key Takeaways on Wage Portage:

- Benefit from a solid legal framework: wage portage is based on clear texts that precisely define your rights and obligations, thus providing a secure professional environment.

- Enjoy a balance between freedom and security: you combine the autonomy of a freelancer with the social benefits of an employee, such as unemployment insurance, retirement, and comprehensive health coverage.

- Simplify your administrative management: by entrusting administrative and legal tasks to your umbrella company, you can fully concentrate on your missions and professional development.

- Increase your income: thanks to the credibility of wage portage, you can charge your services up to 15% more than a traditional freelancer.

- Choose Weepo as your trusted partner: Weepo supports you with efficient digital tools and a dynamic network, providing you with a simplified and effective daily life as a contracted employee.

Definition of Wage Portage

Wage portage, defined by the Labor Code, constitutes a unique tripartite relationship between an independent worker, an umbrella company, and a client company. This mechanism is based on a contractual structure that allows the consultant to combine professional autonomy and social security while benefiting from administrative support.

Specifically, this relationship works as follows:

- An independent worker provides intellectual services to a client company.

- An umbrella company takes care of administrative and legal obligations, including invoicing, payment of social charges, and management of pay slips.

- The client company benefits from the services of the professional without bearing the constraints related to hiring (employment contract, employer charges).

This model is particularly suited for IT professions such as strategic consulting, data engineering, or software development. Consultants often choose this solution when they want to avoid the complexity of creating and managing their own legal structure while securing their activity through a solid regulatory framework.

Wage portage is regulated by articles L.1254-1 and following of the Labor Code. It is a recognized status that offers both guarantees for workers and increased flexibility for companies.

Make an appointment

Advantages of Wage Portage

Wage portage combines the best of both worlds: the independence of freelancing and the social benefits of a traditional employee. Its advantages are numerous and suited to various professional profiles.

1. Professional Freedom

The consultant retains total autonomy in managing their activity. They choose their missions, negotiate their conditions (rates, deadlines), and plan their schedule according to their priorities. This freedom is particularly valuable for experts wishing to work on diverse projects while maintaining a work-life balance.

2. Comprehensive Social Protection

Unlike traditional freelancers, the contracted employee benefits from the security of employee status. This includes:

- Unemployment insurance, providing a safety net in case of cessation of activity.

- A contribution for retirement, ensuring long-term financial preparation.

- Health coverage through mutual insurance and social security.

3. Administrative Simplification

Administrative procedures can be a burden for independents. In wage portage, the umbrella company takes care of:

- Managing invoices and social declarations.

- Establishing pay slips and paying contributions.

- Legal follow-up to ensure compliance of services.

- According to a study by FEPS (European Federation of Wage Portage), 97% of contracted employees report being satisfied with their status.

- Contracted consultants charge on average 10 to 15% more than their freelance counterparts, thanks to the credibility provided by the umbrella company.

Simulate my income in wage portage

Case Study: Marie, Human Resources Consultant

Marie, a human resources consultant with 10 years of experience, decided to opt for wage portage after several years as a freelancer. By joining an umbrella company, she was able to:

- Invoice strategic consulting missions for multinationals without having to create a company.

- Offload administrative formalities, allowing her to focus on her services.

- Access comprehensive social coverage, including unemployment insurance, which she did not have before.

In just 12 months, her revenue increased by 25%, notably thanks to the personalized support offered by the umbrella company, which helped her negotiate her contracts and optimize her rates.

Concrete Example:

A digital marketing consultant invoices services amounting to €8,000 per month. Thanks to wage portage, they retain:

- Comprehensive social protection.

- The flexibility to work for multiple companies without legal constraints.

To learn more, discover all the advantages and disadvantages of wage portage!

How Does Wage Portage Work?

Wage Portage: 4 Essential Steps

The functioning of wage portage relies on a structured process that facilitates the relationship between the contracted employee, the client company, and the umbrella company. Here are the key steps:

1. Finding Missions

The contracted employee identifies professional opportunities with potential clients. This includes prospecting, defining the mission objectives, and negotiating the terms (rates, deadlines, deliverables).

2. Signing a Portage Contract

Once the mission is confirmed, two types of contracts are signed:

- A service contract between the umbrella company and the client company, which frames the mission.

- An employment contract (fixed-term or permanent) between the contracted employee and the umbrella company, which formalizes the employee status.

3. Executing the Mission

The contracted employee carries out the agreed services, respecting the deadlines and requirements of the client company.

4. Invoicing and Payment

The umbrella company manages the invoicing of fees to the client company. Once social charges and management fees are deducted, the contracted employee receives their net salary.

Steps and Responsibilities in Wage Portage

| Step | Main Actor | Description |

|---|---|---|

| Finding Missions | Contracted Employee | Prospecting, negotiating terms, and preparing the mission. |

| Signing Contracts | Umbrella Company | Establishing contracts between the three parties (company, employee, portage). |

| Executing Missions | Contracted Employee | Carrying out the services outlined in the contract. |

| Invoicing and Payment | Umbrella Company | Managing payments and transferring the net salary to the contracted employee. |

- Umbrella companies typically charge an average of 5% to 15% in management fees on gross revenue.

- The contracted employee retains approximately 50% to 60% of their gross revenue as net salary after deductions.

Perspectives of Wage Portage

Wage portage continues to grow in France and Europe, with an annual growth rate of 12% in 2023. This model attracts both young consultants at the start of their careers and experienced professionals seeking to combine independence and stability.

Transforming Your Gross Revenue into Salary through Wage Portage

Wage portage offers a practical solution for converting gross revenue (CA) into net salary while benefiting from the advantages of an employee contract. This mechanism relies on a structured process that combines professional freedom and social protection.

Process of Transforming CA

The conversion of CA into salary follows well-defined steps:

- Invoicing the Client: The professional invoices their services to a client, this amount constituting the gross revenue.

- Management Fees: An umbrella company deducts management fees (between 5% and 15%) to cover its administrative and legal services.

- Social and Tax Deductions: Charges include contributions for social security, retirement, and unemployment insurance.

- Payment of Net Salary: After deducting fees and charges, the net salary is paid to the contracted employee, along with the benefits associated with the status (health insurance, retirement, etc.).

Concrete Example:

For a monthly gross revenue of €10,000 with management fees of 5%, and after social deductions, the professional can receive a net salary of approximately €5,300.

Testimonial: +20% Revenue for Julien, IT Engineer

Julien, an IT engineer, saw his revenue increase by 20% in six months after adopting wage portage. Thanks to this status, he invoices high TJM (Average Daily Rate) services while delegating administrative tasks. This organization allowed him to dedicate more time to his missions while benefiting from increased security.

Salary Simulation in Wage Portage: Calculation Methods and Steps

The salary simulation is a key tool for evaluating potential earnings in wage portage. It is based on several criteria:

- Gross Revenue: Total of services invoiced to the client.

- Management Fees: Deduction by the umbrella company (between 5% and 15%).

- Social Charges: Contributions covering health, retirement, and unemployment insurance.

Simplified Method for Calculating Salary in Wage Portage

Let's take an example:

- Monthly gross revenue: €10,000

- Management fees: 5% (€500)

- Social charges: 40% of gross salary

After these deductions, the net salary of the contracted professional through an umbrella company amounts to approximately €5,300.

The percentage of management fees varies from one wage portage company to another. It is important to compare these fees to choose the most advantageous offer based on your needs and your revenue.

Comparative Study of Revenues by Type of Service

| Type of Service | TJM (€) | Days Worked/Month | Gross Salary (€) | Net Salary (€ after fees) |

|---|---|---|---|---|

| Strategic Consulting | 750 | 16 | 12,000 | 8,400 |

| Web Development | 500 | 18 | 9,000 | 6,300 |

| Professional Training | 550 | 12 | 6,600 | 4,620 |

| IT Project Manager | 650 | 15 | 9,750 | 6,825 |

Growth and Perspectives of the Sector

Wage portage continues to grow. In 2023, this sector experienced a 12% increase in the number of missions completed, reaching over 85,000 collaborations. The average TJM in technical fields, such as IT, is €650/day, placing these professions among the highest earners.

Wage Portage: An Advantageous Status for Freelancers

Wage portage represents an attractive alternative to traditional freelancer statuses. By combining security and flexibility, it offers distinct advantages that meet the needs of independents looking to optimize their working conditions without burdening their daily management.

Why Choose Wage Portage Over Freelancing? Comparison with Other Statuses

Wage portage clearly stands out from other legal options available to independents, notably the status of auto-entrepreneur and that of individual enterprise (EI).

Here is a comparative table of the main criteria:

| Criteria | Wage Portage | Auto-entrepreneur | Independent (EI) |

|---|---|---|---|

| Social Protection | Complete (sickness, retirement...) | Limited | Variable |

| Administrative Management | Reduced (total coverage) | Average | Heavy |

| Unemployment Rights | Yes | No | No |

| Freedom of Action | Yes | Yes | Yes |

Unlike auto-entrepreneurs or independents under the EI regime, contracted employees benefit from extended social protection and enhanced financial security. They still retain total autonomy in choosing their missions and managing their activities.

Unemployment Rights and Enhanced Social Security

A major advantage of wage portage is access to unemployment benefits in case of cessation of activity. This safety net, non-existent for auto-entrepreneurs, constitutes a valuable insurance for professionals subject to income fluctuations.

Moreover, wage portage ensures expanded social coverage:

- Coverage of health expenses through Health Insurance.

- Contributions for retirement, allowing the accumulation of rights.

- Paid leave and insurance, often absent in other regimes.

These protections allow freelancers to focus serenely on their projects without fearing the uncertainties related to the absence of social guarantees.

Streamlined Administrative Management

One of the main challenges freelancers face is administrative management. Between accounting, tax declarations, and various procedures, the time spent on these tasks can be considerable. Wage portage facilitates this process by transferring all administrative responsibilities to the umbrella company. This company takes care of:

- Establishing invoices and contracts with clients.

- Paying social contributions.

- Managing tax declarations and pay slips.

This total support offers a considerable time saving and avoids administrative errors, which can be sources of stress or penalties for freelancers.

Wage portage prevents administrative errors, thus protecting you from penalties and tax hassles.

Preserved Entrepreneurial Freedom

By choosing wage portage, independents retain great freedom in their activity: selecting clients, negotiating rates, and organizing their schedule. Additionally, a guaranteed minimum salary, set by the collective agreement, ensures them financial stability. This specificity also encourages freelancers to diversify their missions and maximize their revenue.

Legal Framework of Wage Portage

Wage portage is based on a precise legal framework that guarantees the security and rights of the parties involved. Recognized as an atypical form of employment in France, it allows professionals to combine independence and social protection. Its legal framework is primarily based on two major texts: the ordinance n°2015-380 of April 2, 2015 and the branch collective agreement signed in 2017. These documents define the rights and obligations of the stakeholders while providing essential guarantees, particularly regarding remuneration, social protection, and administrative compliance.

The 2015 ordinance established the legal foundations of wage portage, clarifying its hybrid nature and the specific roles of each participant. Additionally, the 2017 collective agreement standardized practices within the sector while strengthening the rights of contracted employees. It includes provisions related to training, minimum salary calculation, and the obligation of transparency for umbrella companies.

Obligations of the Stakeholders

The proper functioning of wage portage relies on a balanced and regulated tripartite relationship. Each actor plays an essential role in ensuring compliance and the success of the entrusted mission.

- The contracted employee: they must respect the terms of the contract signed with the umbrella company, including a regular reporting obligation on the progress of their missions and transparency in managing their revenue. They must also meet the objectives agreed upon with the client company.

- The umbrella company: it commits to managing all administrative, tax, and social procedures related to the activity of the contracted employee. This includes paying salaries, managing social contributions, and ensuring compliance with current legislation. It also acts as a guarantor in case of disputes or unpaid invoices.

- The client company: it must provide the contracted employee with the necessary means to accomplish their mission, including an appropriate work environment, the required technical resources, and clear collaboration.

This unique tripartite structure offers a balance between flexibility and security, making it a model favored by professionals wishing to maintain their autonomy while benefiting from the advantages of employment.

Guaranteed Minimum Salary for Contracted Employees

The legal framework imposes a minimum salary for the contracted employee, ensuring financial security despite the independent nature of their activity. According to the 2017 collective agreement, this minimum depends on the status of the consultant:

- Junior consultants (less than 3 years of experience): They receive a gross salary corresponding to at least 70% of the monthly ceiling of Social Security (PMSS).

- Senior consultants or those on a daily rate: Their remuneration must reach at least 75% of the PMSS, which is approximately €3,850 gross monthly in 2024.

This mechanism encourages contracted employees to optimize their revenue while ensuring protection against financial uncertainties. Additionally, contracted employees benefit from the same social rights as employees (health insurance, retirement, paid leave), distinguishing them from independent workers.

Key Statistics on Wage Portage in France

Wage portage is booming in France, with steady growth since its official recognition in 2008. In 2023, several data points illustrate this impressive growth:

- Sector Revenue: Over €1 billion, making it an important component of the independent worker economy in France.

- Number of Professionals Involved: Over 100,000 consultants and freelancers operate under this status, a number that is constantly increasing.

- Annual Growth: The sector has recorded an average growth of 10% per year since 2015, thanks to a growing demand for flexibility in the world of work.

These figures testify to the attractiveness of wage portage for independents, as well as for companies, which see it as an agile and secure solution for outsourcing their projects.

Wage portage is increasingly attracting young graduates and seniors undergoing professional retraining, due to its flexibility and social benefits.

Choosing Your Umbrella Company

Choosing an umbrella company is a crucial decision for any freelancer or consultant. It is essential to select a partner that meets your professional and personal needs. Here are the key criteria to consider for making an informed and optimized choice:

1. Management Fees: A Determining Factor

Management fees are a primary factor in choosing an umbrella company. Each company applies fees that vary based on the services offered and the structure of the business. Generally, these fees represent a percentage of your gross revenue, but some providers may also charge fixed or specific fees depending on the additional services provided.

It is therefore important to compare these fees among different companies to determine the real cost of wage portage. This criterion will directly impact the net remuneration, so it is advisable to choose a company with fees suited to its activity.

Advice: Don’t forget to check for hidden fees, such as costs related to mission management or administrative fees. A company that is transparent on this point will save you from unpleasant surprises.

2. Services Offered: A Complete and Tailored Offer

Some umbrella companies go beyond simple administrative management services and offer additional services that can greatly simplify the daily work of contracted employees. These services may include:

- Accounting Management: some companies handle all accounting management, allowing you to focus on your core business without worrying about tax declarations or financial statements.

- Legal Advice: experts can guide contracted employees on legal issues related to their missions, such as contracts, legal obligations, and compliance.

- Professional Training: some companies offer training programs to help develop technical, commercial, or management skills.

Our Advice: Evaluate these services based on your specific needs. For example, if you need legal support, choose a company that includes this service in its offer.

3. Company Reputation: Trust Above All

A reputable and reliable company will have a solid base of satisfied clients and recognized expertise in the field. Here are some ways to verify a company's credibility:

- Reviews from Other Freelancers and Consultants: consulting testimonials and reviews from other professionals who have already worked with the company can provide insight into the quality of its service.

- Labels and Certifications: look for certifications or labels that demonstrate the company's compliance with industry standards. For example, some providers may be labeled French Tech, which guarantees a cutting-edge service.

- Reputation in the Sector: companies recognized in the freelance and consulting ecosystem are often those that have established themselves through recognized expertise and quality customer service.

Our Advice: Do not rely solely on the information available on the company's website. Look for external reviews to get a more objective view.

4. Personalized Support: Tailored Assistance to Your Needs

Support is one of the most important aspects of wage portage, especially for independents at the beginning of their careers or those with specific needs. A quality umbrella company should be able to offer its contracted employees personalized follow-up to help them succeed in their activity.

- Dedicated Advisor: some companies assign a personal advisor for the entire journey within the umbrella company. This support is particularly valuable for novices in the freelancing world or in complex situations.

- Support for Finding Missions: finding new clients, missions, or developing your network becomes easier with good support.

- Performance Monitoring: some umbrella companies offer regular assessments to optimize revenue and help their contracted employees achieve their professional goals.

Our Advice: If support is a priority for you, choose an umbrella company that offers a close relationship and quality follow-up.

5. Social Guarantees and Coverage Offered: Security Above All

In addition to management fees and services, it is imperative to check the social coverage and guarantees offered by the umbrella company. Some companies offer comprehensive social protection, including:

- Retirement: retirement contributions, often overlooked by freelancers, are crucial for preparing your future.

- Unemployment Insurance: although unemployment is not always covered by wage portage, some umbrella companies offer options to be protected in case of mission loss.

- Health Insurance: if the company offers health insurance, it is important to check if it meets your needs.

Our Advice: Choose a company that offers comprehensive and competitive social coverage to benefit from the same protections as a traditional employee.

What is the Best Umbrella Company?

There is no single answer to this question, as the "best" umbrella company depends on the specific needs of each consultant. However, certain criteria can help determine the companies best suited to different situations:

- Reputable Companies: some companies like ITG, Régie Portage, or Openwork are widely recognized in the sector and have extensive experience with consultants. They are often considered references.

- Support and Services: a quality umbrella company will offer personalized support and additional services such as invoicing management, ongoing training, and retirement or health insurance solutions tailored to the needs of independent workers.

- Management Fees and Flexibility: the best umbrella company offers transparent and reasonable management fees while providing flexible conditions for consultants. A good balance between cost and services is essential.

Ultimately, the best umbrella company is the one that best meets the professional expectations of the contracted employee while offering the most advantageous conditions for their activity.

Why Choose Weepo as Your Partner in Wage Portage?

Choosing Weepo means opting for a modern and transparent solution that offers you the freedom of freelancing while benefiting from the security of an employee. Discover the advantages of simplified management, complete social security, and optimized remuneration.

Advantages of Weepo

1. Transparency of Fees

Unlike other players, Weepo guarantees total transparency on its fees, with no hidden costs. You have a clear view of your income for simplified management.

2. Freedom and Autonomy

Choose your missions, negotiate your rates, and work with the clients of your choice, all while benefiting from personalized support to maximize your opportunities.

3. Comprehensive Social Security

Weepo offers you social protection equivalent to that of a traditional employee: unemployment, retirement, mutual insurance, and paid leave.

4. Personalized Support

A dedicated advisor accompanies you at every step to optimize your mission management and income.

5. Efficient Digital Tools

With an intuitive platform, manage your missions and track your income effortlessly.

The Status of Contracted Employee with Weepo is...

Weepo provides a compliant and modern legal framework for freelancers. The company simplifies your wage portage experience by combining security and smooth digital management.

A Modern Platform for Freelancers

Our dedicated platform allows you to manage your missions and income intuitively and effortlessly.

With Weepo, you have access to cutting-edge digital tools that allow you to easily track your performance and income in real-time.

An Innovative Support Model

Weepo is not just a classic umbrella company; it combines cutting-edge technology and expertise to offer personalized support to its contracted employees.

Weepo is the first wage portage company labelled French Tech and incubated at Station F, a testament to its innovative approach.

Transparent and Attractive Remuneration

Thanks to optimal management of contributions and professional fees, Weepo maximizes your net salary while respecting the collective agreement.

| Criteria | Weepo |

|---|---|

| Management Fees | No hidden fees, everything is clear |

| Social Contributions | Optimization of charges for a high net salary |

| Remuneration | Respect for minimum thresholds and fair remuneration |

A Community of Experts

Join over 300 consultants within our network and enjoy a dynamic environment conducive to collaboration and skill exchange.

An International Partner for Your Missions

Weepo facilitates the management of international missions while ensuring French social protection.

Additionally, the Talent Passport is compatible with wage portage. The chances of the contracted employee renewing their residence permit, or even being naturalized, are significantly increased.

Additional Services Offered

- Professional Training to enhance your skills.

- Access to a network of professionals to boost your business opportunities.

- Personalized Advice to improve your performance.

Weepo is the ideal partner for freelancers seeking a modern, flexible, and secure solution in wage portage. With innovative tools, optimized remuneration, and tailored support, Weepo allows you to focus on what matters most: your missions.

Ready to join Weepo? Discover how we can transform your freelance activity. Contact us now and get personalized support and mission offers tailored to your profile!

Start you wage portage adventure in 2H with WEEPO!

Consultant area

Wage Portage: Key Points to Remember:

- Wage portage combines independence and security, offering freelancers a solid legal framework.

- It allows you to transform your revenue into net salary while avoiding administrative constraints.

- With Weepo, you benefit from:

- complete transparency on your fees,

- tailored support,

- an intuitive platform to manage missions and earnings.

- Conclusion: Weepo offers the freedom of freelancing + the security of employment.

All about wage portage

Advantages and disadvantages

Contract

- Wage portage or freelancer : what to choose?

- Wage portage or CDI: which solution to choose?

- Wage portage or freelance : what to choose?

- Wage portage or SASU : which to choose?

- URSSAF and wage portage : how does it work?

- Maternity Leave and Wage Portage: How Does It Work?

- Paternity Leave and Wage Portage: What Rights?

- Wage Portage vs Entrepreneurial Portage: Which Status to Choose?

- Resignation in wage portage: the points to know

- Wage Portage VS Temporary Work in IT: Key Differences

- Mutual Termination in Wage Portage: Guide

- Wage Portage and Maximum Duration of Service Provision

- End of mission in wage portage

Regulations

- How does sick leave work in wage portage?

- Does wage portage give the right to paid leave?

- Collective agreement and wage portage

- Does wage portage give right to training?

- Financial guarantee in wage portage: what conditions?

- Legal status and wage portage: understand everything

- Wage Portage: What Are Management Fees?

- Labor Law: Rights and Obligations of the Ported Employee

- Who Can Opt for Wage Portage?

- Mandatory Insurances for Wage Portage Employees

- Professional Expenses in Wage Portage: The Guide

Compensation

- Calculation of wage portage: how to do it?

- Unemployment and wage portage: what conditions?

- The kilometric expenses in wage portage

- Taxes and wage portage: what taxation?

- Wage portage and retirement: how does it work?

- Meal tickets and Wage portage

- Company Car in Wage Portage: What You Need to Know

- Withholding Tax in Wage Portage: The Guide

- Wage Portage and RSA | Cumulative Conditions